Common Law, Commercial Law and statutory law require contracts.

So, why haven’t you got a contract for your ‘mortgage’?

In the previous article, I focused on the fact that a mortgage deed cannot be materially altered after it has been signed and the sound reasoning behind it. The Great British Mortgage Swindle is also dependent upon the fact that there is no valid contract between the bank and the individual, in spite of the age old principles of contracts being required for such agreements to be valid.

It’s now 10 ½ years since I asked Richard Pym, the CEO of the Bradford and Bingley PLC to provide me with the lawful bi-lateral contract, signed by a representative of the bank and myself.

The response was to state that the deposit of the deed created the contract.

A contract is an agreement and when the agreement is for the sale of land and property, it makes sense to have it in writing.

Few could argue with that.

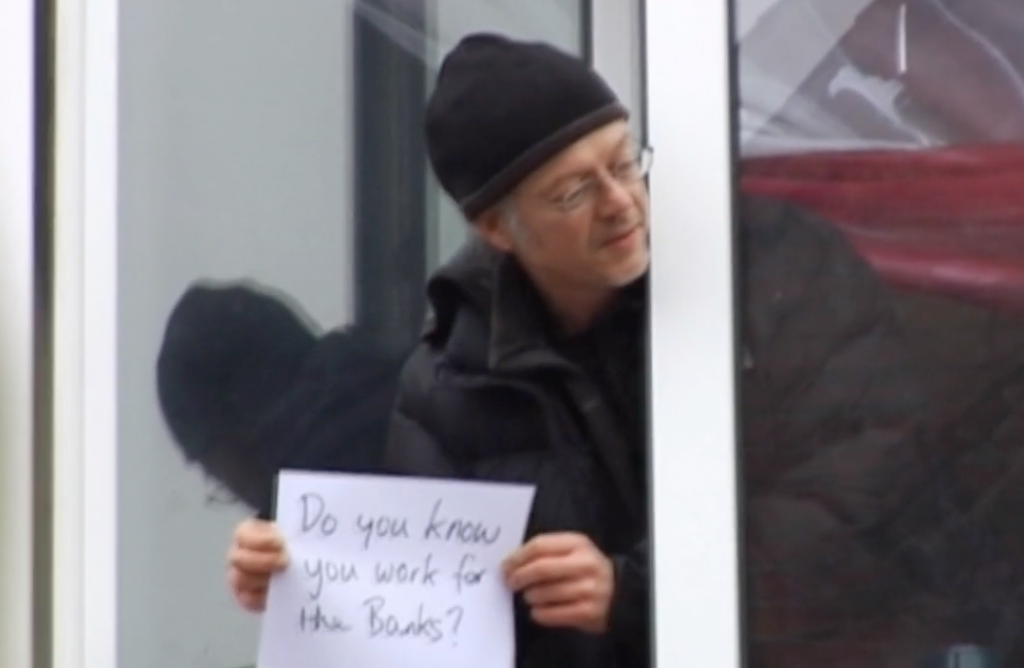

Yet, when I presented in Nottingham County Court that long-established principle of law that for a contract to be valid there had to be consideration on both sides and that a written agreement, signed by all parties was required for the lawful creation of the ‘mortgage’, Richard Inglis (above, left), the man acting as judge claimed what I was stating had “no basis in English Law”. He also falsely adjudged the same of the commercial lien which had been served on said CEO.

He dismissed the arguments as “entirely without merit”.

This still sticks in my craw somewhat as without his void judgement, I would not have had my house violently stolen.

Of course, he was lying. To himself, to the court, to me and to his maker.

The fact is that he and all the other judges who have falsely stated that there does not have to be a written contract in place for a bank to steal your home, aided and abetted by the police and the bailiffs, have time after time, revealed themselves to be as full of fallacy as a cowshed is full of shit.

No merit in English Law? How could it be then that the Statute of Frauds 1677 S.4 states:

IV. Noe Action shall be brought . . . F1 whereby to charge the Defendant upon any speciall promise to answere for the debt default or miscarriages of another person . . . F2 unlesse the Agreement upon which such Action shall be brought or some Memorandum or Note thereof shall be in Writeing and signed by the partie to be charged therewith or some other person thereunto by him lawfully authorized.

The Law of Property (Miscellaneous Provisions) Act 1989 S.2(3) also makes this plain:

2(3) The document incorporating the terms or, where contracts are exchanged, one of the documents incorporating them (but not necessarily the same one) must be signed by or on behalf of each party to the contract.

Bouviers Law Dictionary on Contracts is equally clear:

6. – 2d. There must be a good and valid consideration, motive or inducement to make the promise, upon which a party is charged, for this is of the very essence of a contract under seal, and must exist, although the contract be reduced to writing. 7 T. R. 350, note (a); 2 Bl. Coin. 444. See this Dict. Consideration; Fonb. Tr. Eq. 335, n. (a) Chit. Bills. 68.

7. – 3d. There must be a thing to be done, wbicb is not forbidden; or a thing to be omitted, the performance of which is not enjoined by law. A fraudulent or immoral contract, or one contrary to public policy is void Chit. Contr. 215, 217, 222: and it is also void if contrary to a statute. Id. 228 to 250; 1 Binn. 118; 4 Dall. 298 4 Yeates, 24, 84; 6 Binn. 321; 4 Serg & Rawle, 159; 4 Dall. 269; 1 Binn. 110 2 Browne’s R. 48. As to contracts which are void for want of a compliance with the statutes of frauds, see Frauds, Statute of.

The requirement for a legally binding mortgage contract was brought into legislation 30 years ago as a result of the Law Commission’s recommendations. On 24 January 1989 ~ The Lord Chancellor (Lord Mackay of Clashfern) addressed the House of Lords with his reading of the Law of Property (Miscellaneous Provisions) Bill [H.L.]. He stated the intention of ‘Clause Two’ (Section 2):

“The Law Commission recommended that contracts for the sale or other disposition of land should not be valid unless they are made in writing and that writing is signed by all the parties to the contract. The clause gives effect to that recommendation. It was made after wide-ranging consultation by the commission.

It seems right that contracts as important as contracts for the sale or other disposition of land be in writing. The clause removes the possibility of an oral, binding, but unenforceable contract. It ensures that all the parties to a contract must sign it. The clause has been drafted so as not to interfere with the usual practice of exchanging contracts.”

Hansard, vol 503 cc598-611

On Wednesday 12 July 1989 an article (now removed) in the Law Society’s ‘Law Gazette’ addressed the changes to the Law of Mortgages:

“… First, all contracts for the sale or other disposition of an interest in land will have to be in writing; it will not be possible to have an oral contract evidenced in writing. The danger of inadvertently creating a s.40 memorandum (for example, by a solicitor’s letter) is therefore removed. Solicitors could therefore discontinue the practice of making pre-contract correspondence ‘subject to contract’.

As has just been mentioned, there is no need to prevent the letter being evidence of an oral agreement and although contracts could still be created by correspondence, a solicitor has no implied authority to sign a contract on behalf of a client.

Secondly, the signatures of all parties must be present; s.40 lacked this element of mutuality.

Thirdly, non-compliance with the rule will make the contract void rather than unenforceable, as under s.40 …“.

On 26 September 1989 ~ The LPMP Act came into full cause and effect; s. 2(1) prescribes that a contract for a mortgage is required by law, with s.2(3) stating that a document incorporating the terms executed by both the mortgagee and the mortgagor, is also required by law.

Wherefore, on 26 September 1989 ~ the implied contract in every mortgage deed prior to the 1989 act no longer has legal effect, on the basis that s2 prescribes that it can only be expressed in writing, signed by both parties, with all of the fairly negotiated terms in a single document.

Paragraph 4.8 of the Law Commission Report No 164 titled ‘Transfer of Land Formalities for Contracts for Sale Etc of Land’ states:

“Signature

4.8 It was proposed in the working paper, and we now recommend, that the contract should be signed by all the parties to the contract or by persons authorised to sign on their behalf. One of the most frequently voiced criticisms of section 40 is that it is one sided; a person who has not signed any written evidence can choose to sue the person who has, even though he could not himself be sued.

This want of mutuality in ability to enforce a contract involves an obvious measure of injustice; certainly it is contrary to the ordinary equitable requirements for specific performance, so that a somewhat strange anomaly may be detected in that this remedy may be ordered despite non-compliance by one side with the statutory formalities.

We do not believe that it will cause difficulty or noticeably increase expense to insist that all parties (or their agents) sign the contract.This would not only be in the interests of certainty and justice, but would also be in complete accord with current practice.”

The requirement that all parties sign a contract is also definitive in binding case law from United Bank of Kuwait Plc v Sahib & Ors [1996] EWCA Civ 1308 within which it states:

“The effect of section 2 is, therefore, that a contract for a mortgage of or charge on any interest in land or in the proceeds of sale of land can only be made in writing and only if the written document incorporates all the terms which the parties have expressly agreed and is signed by or on behalf of each party. In the present case it is not suggested that there is any such written document.”

“I therefore conclude that by reason of section 2, the mere deposit of title deeds by way of security cannot any longer create a mortgage or charge.”

Furthermore Cousins Law of Mortgage (2010) 3rd Edition affirms that:

“… Where a purported contract for the grant of a mortgage on or after September 26, 1989 fails to comply with the requirements of section 2 of the Law of Property (Miscellaneous Provisions) Act 1989, no mortgage will be created and, notwithstanding any oral agreement or deposit of title deeds, the creditor will have no interest in or rights over the debtor’s land […] It follows that the failure to comply with section 2 will provide a defense to any claim for possession pursuant to a mortgage.” (Page 610-611)

And Chitty on Contracts (2008) 30th edition, page 417 clearly states:

“iii. The effect of failure to comply with formal requirements – Effect of non-compliance…any agreement not complying with the requirements of s2 of the 1989 Act is a nullity.”

Fisher & Lightwood (Jul 2010) 13th Ed page 41 reveals ‘interim equitable mortgage phase’:

“… Defective legal mortgage … for an informally executed legal mortgage … to take effect as an equitable mortgage it must nonetheless comply with the [s.2(3) LPMPA] provisions … moreover as informally executed mortgages are frequently executed only by the mortgagor this may result in many such mortgages not creating any contract and security interest at all …”

Conclusion: the entire conveyancing industry has been manifestly breaking the law by failing in its duty of care to its clients. The case for which is clear. Given there is no consideration on the part of the licensed banks, any and all perceived debt or obligation to ‘pay’ is nothing more than an elaborate swindle involving some 11.2 million ‘mortgagors’. That fact also explains how and why the bank’s representatives never sign any contract or, indeed, put their names and signatures to any document.

The mortgage is a fraud: no consideration, no debt and no valid deed. None of which is adequately explained by a conveyancing solicitor, rendering it all unlawful, whichever way one wishes to cloak it.

“Woe unto you, lawyers! For ye have taken away the key of knowledge: ye entered not in yourselves, and them that were entering in ye hindered.” — Luke. XI, 52.

TGBMS Links

Buy the DVD (https://thegreatbritishmortgageswindle.us20.list-manage.com/track/click?u=d15706cafc460fd76074a0069&id=3aa64175f0&e=483727ac6f)

Watch on Amazon Prime (https://thegreatbritishmortgageswindle.us20.list-manage.com/track/click?u=d15706cafc460fd76074a0069&id=d173e8fbab&e=483727ac6f)

Book Cinema Tickets (https://thegreatbritishmortgageswindle.us20.list-manage.com/track/click?u=d15706cafc460fd76074a0069&id=588e7d8966&e=483727ac6f)

Download Free PDF of TGBMS: Next Steps (https://thegreatbritishmortgageswindle.us20.list-manage.com/track/click?u=d15706cafc460fd76074a0069&id=464b61d3d1&e=483727ac6f)

I just don’t fathom why the banks simply don’t sign the documents. what do they have to gain by not doing so? Seems, they now have everything to lose. Surely, it can’t just be arrogance and the fact that the banks have been backed up by the courts to steam roll mortgagors

Hi,hemi

it’s a very good question. The answer lies within the manifestly criminal mindset and industrial scale fraud that permeates every level of the banking sector. Here is the reasoning behind the requirement for an agreement (contract) signed by all parties:

No signature, no one to sue.