I’ve previously written in substantial length about the Great British Mortgage Swindle and the components of its multi-layered mortgage fraud.

To the average man in the street, the one who falsely believes he was the recipient of a loan from a mortgage provider, it is far too complex for him to get to grips with. As far as he is concerned, part of him knows it is a fraud on the simple basis that no matter how much he pays, the ‘debt’ hardly diminishes on account of the compound interest he is forced to pay. For those in authority, who sit on the banking gravy train and consequently have no incentive to do anything about the fraud, it’s of passing interest at most.

The demonstrable fraud that forms the basis of the unprecedented representative action against the Chief Land Registrar lies in the very deed of mortgage itself. The dictionary definition of the term makes it plain: it a ‘dead pledge’ or promise.

mortgage | ˈmôrɡij |

noun

a legal agreement by which a bank or other creditor lends money at interest in exchange for taking title of the debtor’s property, with the condition that the conveyance of title becomes void upon the payment of the debt. (My emphasis)

Aside from the issue of the fake loan of “money at interest”, it is common sense that the mortgage can only be against the “debtor’s property”. In other words, an individual can only grant such a charge over his home if it is truly his – he has first to be the beneficial owner before he can sign (execute) the deed, let alone a “debtor”.

Due to the fact that his conveyancing solicitor instructed him to do so at a time when the house was palpably not in his ownership, that deed is provably illegal, ab initio. And, most significantly, the so-called ‘mortgagor’ can prove it.

This is why the solicitor illegally instructs him to execute but not date the mortgage deed.

Thus, the fraud is hidden in plain sight, as an esoteric* element that is often over-looked and/or dismissed on the ground it is the ‘common practice’. The appeal to common practice is a fallacy and therefore cannot be relied upon as a defence. The reasoning is clear: just because something is done in a particular way does not make it lawful or, indeed, legal.

*esoteric | ˌesəˈterik |

adjective

intended for or likely to be understood by only a small number of people with a specialized knowledge or interest: esoteric philosophical debates.

The Land Registry, the Conveyancing industry and the banks will each argue that regardless of the facts, the deed is legal.

My colleague and co-producer of TGBMS, Michael O’Bernicia, brilliantly distills it down to this:

“There is one question knocks out their deed argument: what is the one legal requirement of proving that a mortgagor has granted a legal mortgage?

That they signed an equitable mortgage deed, capable of being registered as a legal mortgage, as per the provisions of s1 LPMPA 1989 in front of an independent witness, who attested to the signatures.”

Further,

“Without which components of the deed is it incapable of being registered as a legal charge?

Answer: The signature of the mortgagor and the date of execution [not completion].

Therefore, the LR assumes that the date on every deed is the date it was signed and common practice does not provide a defence to the falsification of it on the date of completion.

An undated cheque is always sent back to the maker, who is the only party who can amend the instrument. however, whilst post-dating can be acceptable with a cheque, the same is not true of deeds, unless more than one party is signing and they are in different locations.

However, since an undated deed cannot be registered, even when it is signed; just as an unsigned deed cannot be registered, even if it bears a date; the law presumes that the acts of signing and dating are indivisible, on the ground that Southern Pacific Mortgage case ruled that the entire mortgage transaction, from execution to completion, is indivisible, which naturally means that no right to grant an interest arises until completion.”

Then, of course, we have the etymology of the word ‘mortgage’ itself which makes it plain that there is something inherently nefarious about the whole swindle:

“late Middle English: from Old French, literally ‘dead pledge’, from mort (from Latin mortuus ‘dead’) + gage ‘pledge’.”

The adage, if you want to hide something, hide it in plain sight was never so apt.

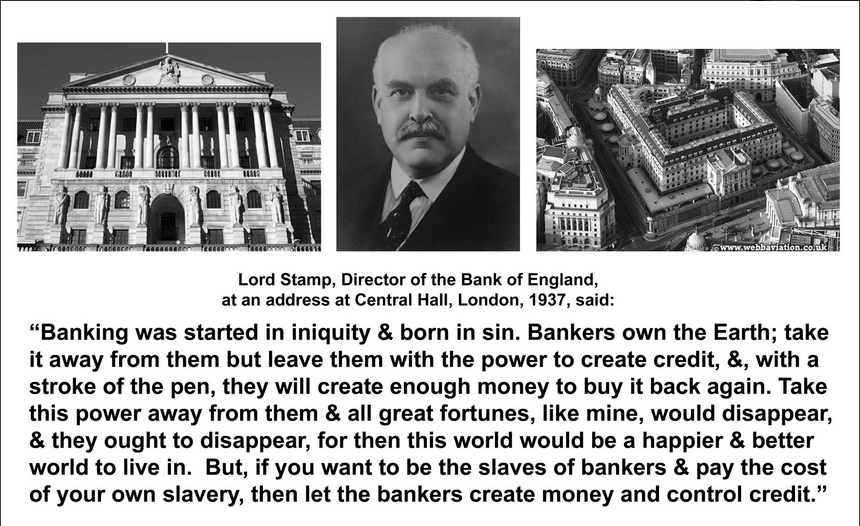

And that is aside from the issue of ‘mortgage monies’ as created out of thin air:

Or, as Henry Ford put it:

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

Little wonder that the so-called ‘education system’ does not teach its inmates anything about the creation of ‘money’ by way of fake debt. It is in the interests of the bankster and their accolytes for their fraud to remain hidden. In psychological warfare (which is is what it is, on every level) it is important to maintain the cover-up; which is why groups like this are created to steer people away from the facts and into a limited hangout of hidden trusts that can never be substantiated and false promises of ‘golden keys’ that will magically open up the rigged court system for those ‘in the know’. But only if you pay them thousands first.

Mortgage fraud exists on an industrial scale: it’s a huge scam, one of financial enslavement, which is entirely dependent on the masses remaining ignorant to its hidden practices.

The solution: watch TGBMS, get educated and join the class action against the Land Registry.

If you haven’t done so already, here are the links to join the class actions and upload your void mortgage documents, for the singular purpose of providing us with sufficient evidence of institutionalised mortgage fraud.Join the TGBMS Class Actions:

TGBMS Links

Visit the official website for The Great British Mortgage Swindle:

https://www.thegreatbritishmortgageswindle.net

Watch on Amazon Prime:

https://www.amazon.co.uk/Great-British-Mortgage-Swindle/dp/B07L9WT5JM/

Buy the DVD on Amazon:

https://www.amazon.co.uk/Great-British-Mortgage-Swindle-DVD/dp/B07CXC36KG/

See the film in a UK cinema:

Great article. Let’s hope TGBMS will get the just results. And all the individuals “ACTING” as lawful judges and barristers over fake court proceedings, be banged up – as per our campaign at http://www.ScamBuster.TV

Hello, how can people uploading their documents to TGBMS site contact the organisers? I am yet to be contacted by my area rep and my message to TGBMS on facebook is unanswered.

Hi, JD

please drop us a line at info@thegreatbritishmortgageswindle.net and we will sort it out.

All the best, Michael

Any info for US home owners?

The elements of the swindle are the same the world over, bar one or two cosmetic differences. If you haven’t seen it yet, it can be viewed here

Pingback: Fraud Vitiates All - ROGUE MALE